are union dues tax deductible in california

June 1 2019 818 AM. As part of the new state budget recently signed by Newsom.

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

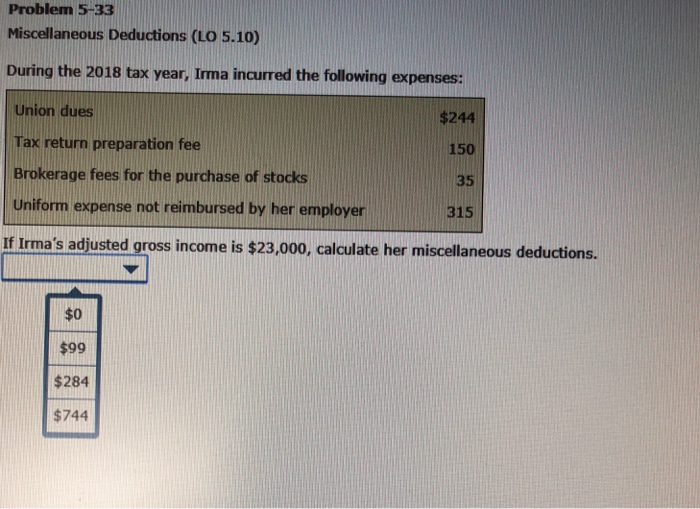

Subscriptions to trade business or professional associations.

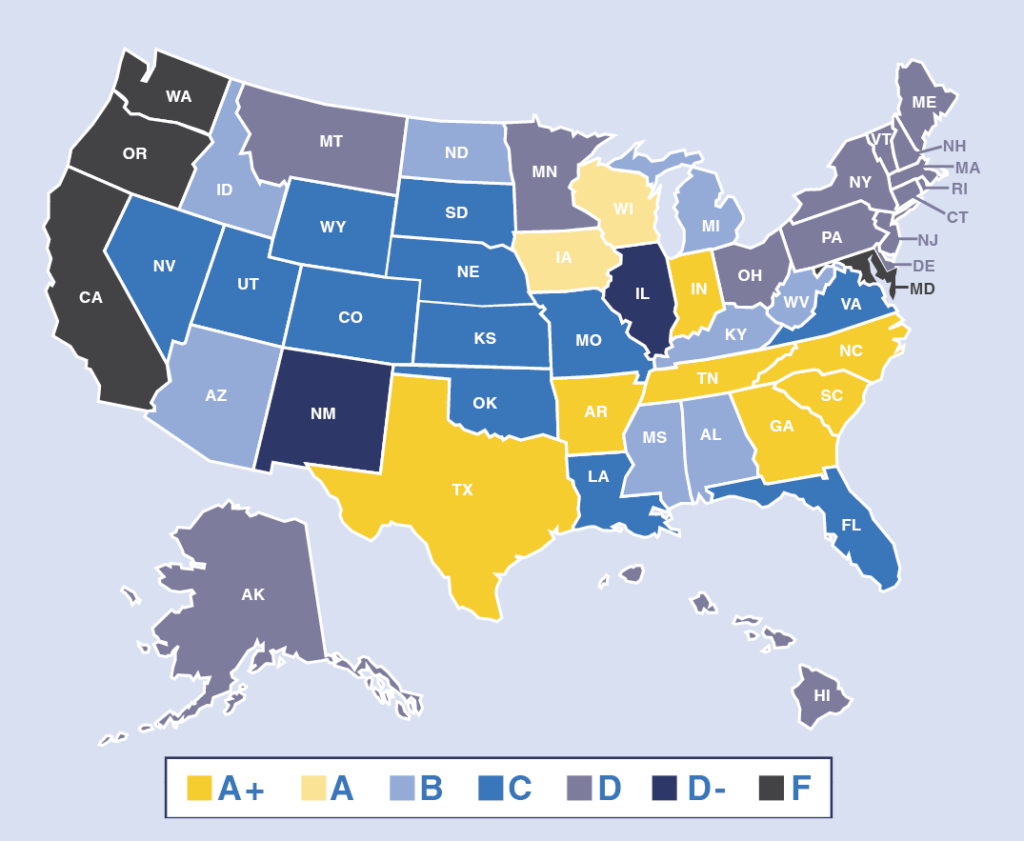

. California is one of only a handful of states where union dues are tax deductible for state income tax purposes. Minimum standard deduction 2. As part of tax reform unions due to deductions will no longer be allowed.

Single or marriedRDP filing separately enter 4803. For tax years 2018 through 2025 union dues and all. Answer No employees cant take a union dues deduction on their return.

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized. This bill would allow taxpayers a deduction of union dues paid in calculating their AGI. Federal law used to allow dues to be deducted but the Tax Cuts and Jobs Act of 2017 removed the deduction according to tax filing guidance from HR Block.

Union Dues You can deduct dues and initiation fees you pay for union membership. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed. Employers must honor the terms of an employees written authorization for union dues deductions.

California along with other states including Pennsylvania and New York already allows union members to lower their taxable income by the amount of their union dues through. Current state law already allows taxpayers to deduct their union dues paid as a miscellaneous itemized. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that.

FREE for simple returns with. Dues and any employee expenses not itemized by an employee are no longer tax-deductible regardless. 2577 would have allowed union members in California to deduct their dues on their state personal income tax.

Deductions expressly authorized in writing by the employee to cover insurance premiums hospital or medical dues or other deductions not amounting to a rebate or deduction from the. The floor report notes that though union dues are already tax deductible union workers are more likely to not itemize their deductions and therefore do not get the same tax. The TCJA made union dues non-tax deductible Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses.

If a union certifies that it has and will maintain employees written. Enter amount shown for your filing status. It was supported by PORAC and AFL-CIO but died in Senate.

As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income tax. You cannot deduct union dues on your state return. Enter the larger of line 1 or line 2 here 3.

The payment of a bargaining agents fee to a union for negotiations in relation to a new enterprise agreement. California follows the federal rule. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

Relax Federal Law Won T Raise Your California Income Tax

Itemized Deductions For California Taxes What You Need To Know

Solved Problem 5 33 Miscellaneous Deductions Lo 5 10 Chegg Com

Itemized Deductions For California Taxes What You Need To Know

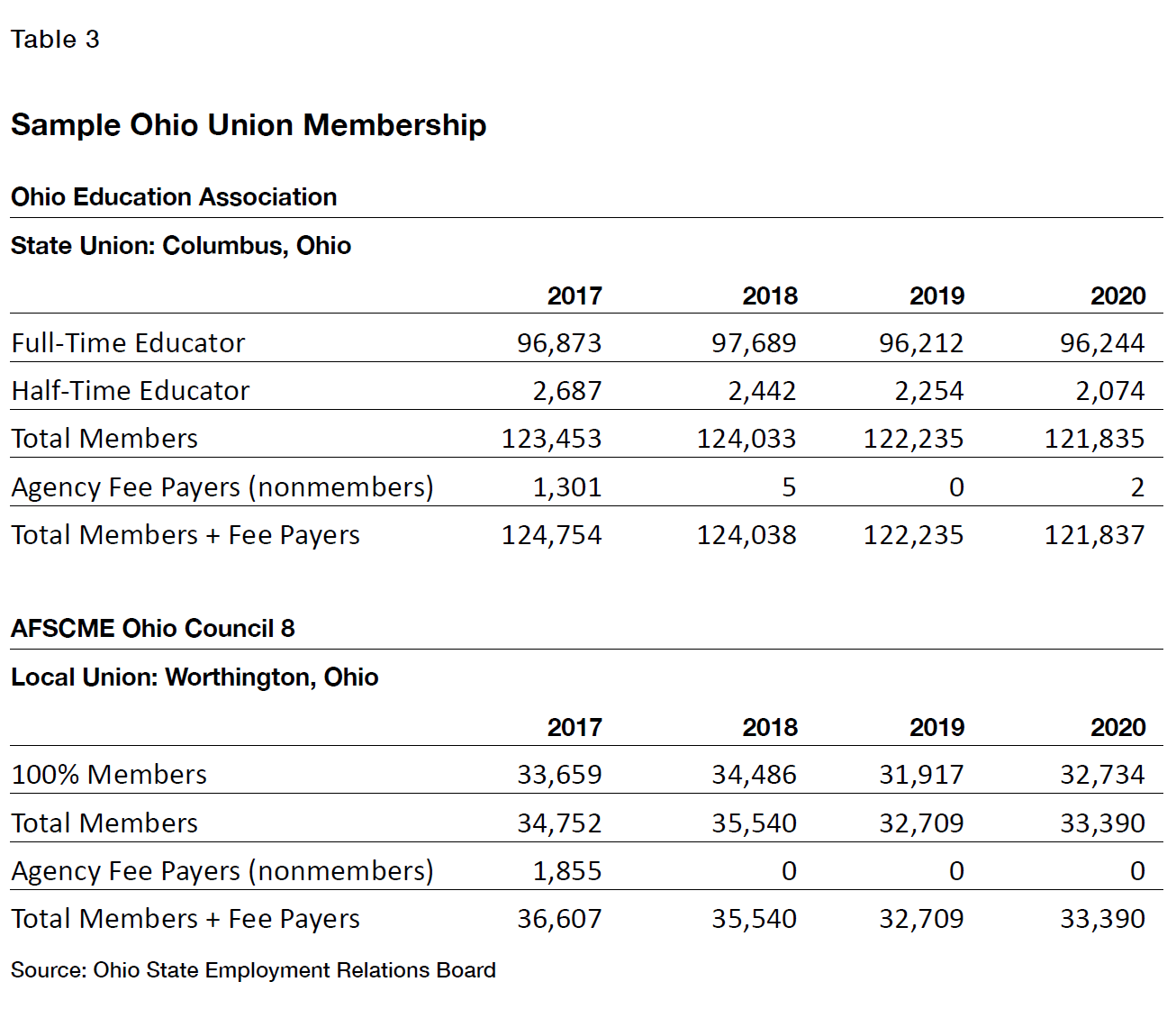

By The Numbers Public Unions Money And Members Since Janus V Afscme Manhattan Institute

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

New W 2 Box 14 Printing Options Datatech

Relax Federal Law Won T Raise Your California Income Tax

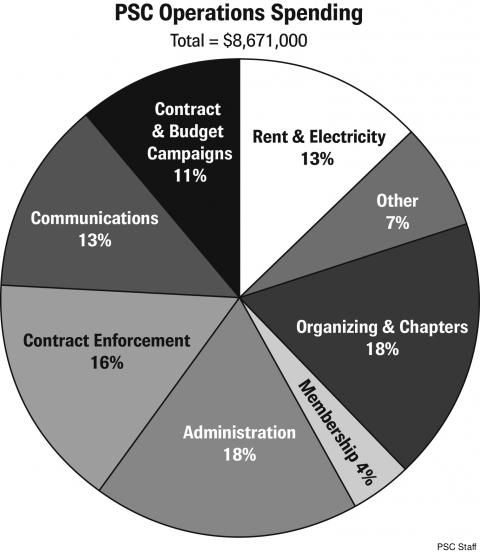

Union Station California S Workers Tax Fairness Credit Would Be The First Tax Credit For Union Dues In The U S Ballotpedia News

Union Station California S Workers Tax Fairness Credit Would Be The First Tax Credit For Union Dues In The U S Ballotpedia News

Taxes For Actors 2020 Deductions Deadlines More Backstage

Tax Preparers Warn Your Refund May Be Smaller Than Usual This Year Here S Why Los Angeles Times

Can You Deduct Union Dues From Federal Taxes

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Union Station Comments On Proposed Rule Affecting Union Dues Deductions Ballotpedia News

Membership Benefits California State University Employee Union Csusm