1031 tax deferred exchange meaning

Its important to keep in mind though that a 1031 exchange may. Why deal wtenants toilets trash.

Top 1031 Exchange Real Estate Strategy Tips For 2022 Nnndigitalnomad Com

Experienced in-house construction and development managers.

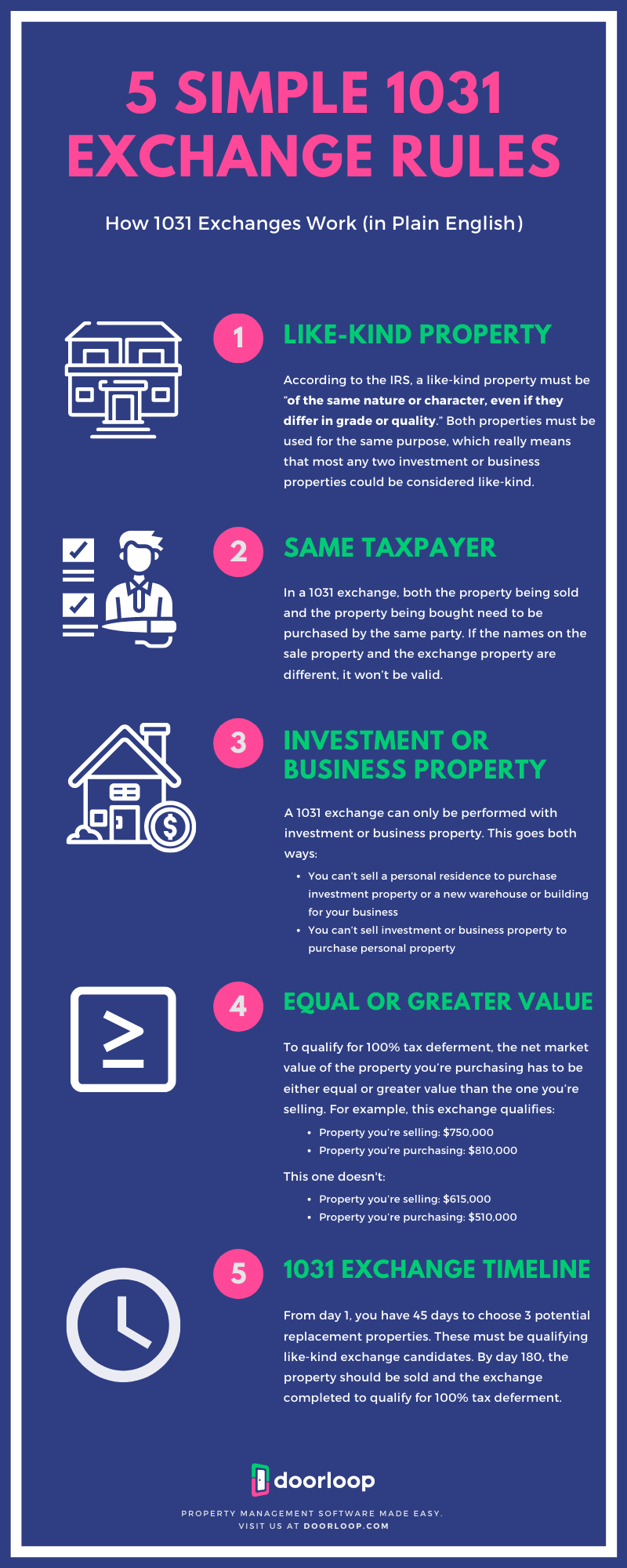

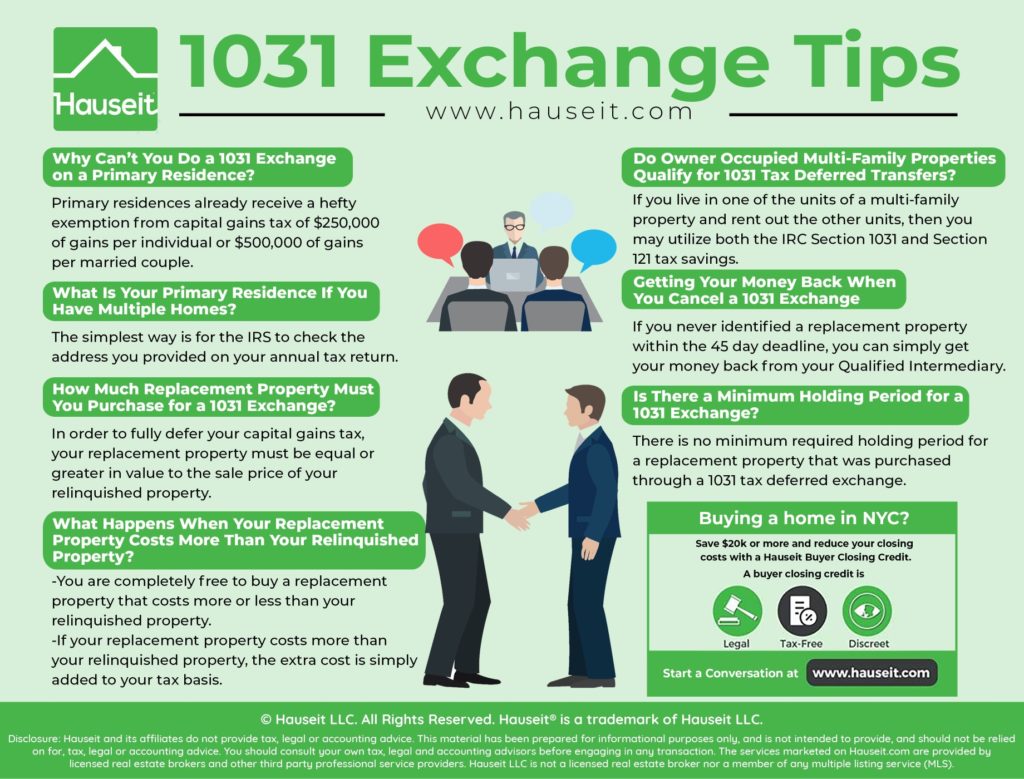

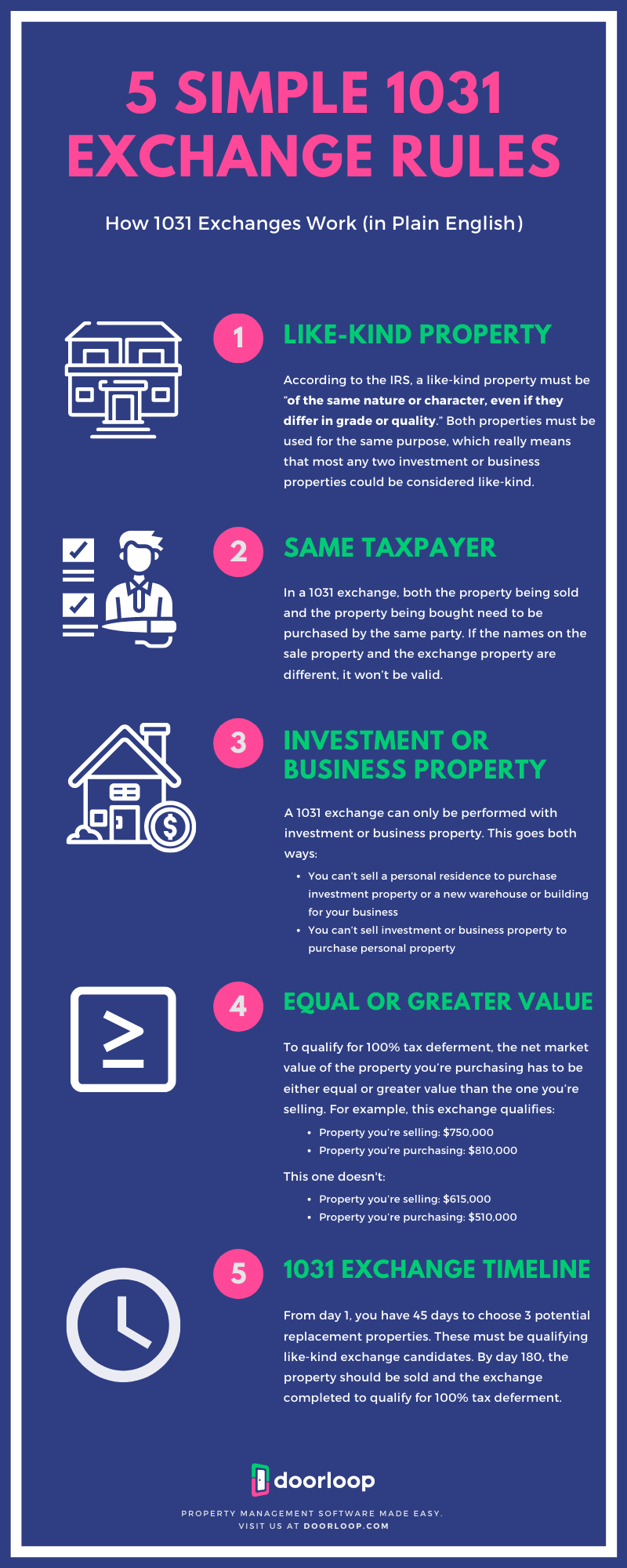

. The 1031 exchange is in effect a tax deferral methodology whereby an investor sells one or several. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of your. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property.

No-hassle passive income now. A capital gain refers to profit that results from a sale of capital assets like stocks bonds and real estate. Ad Invest in Silicon Valley Real Estate.

Call now for your 100 free consultation. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property. For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are. A 1031 exchange is a tax break. Thanks to the 1031 exchange you can reinvest the profits into.

For example if you purchase a property for 300000 and. If the sale price exceeds the purchase price the. A tax deferred exchange is a transaction that permits taxpayers to sell an asset held for investment or business purposes use the proceeds to purchase a like kind investment and.

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes. Top 10 Reasons Real Estate Investors Are Jumping into DSTs.

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save. What Does Tax Deferred Mean. Ad Own Real Estate Without Dealing With the Tenants Toilets and Trash.

Everything You Need to Know to Save Paying Capital Gains Tax. Ad Consult with an expert at the nations largest 1031 Qualified Intermediary today. Avoid As Much As 40 Profit Loss To Taxes.

Experienced in-house construction and development managers. Rules governing reverse 1031 exchanges are complex. The company was founded in 1994 and has been the trusted advisor to thousands of real estate investors across.

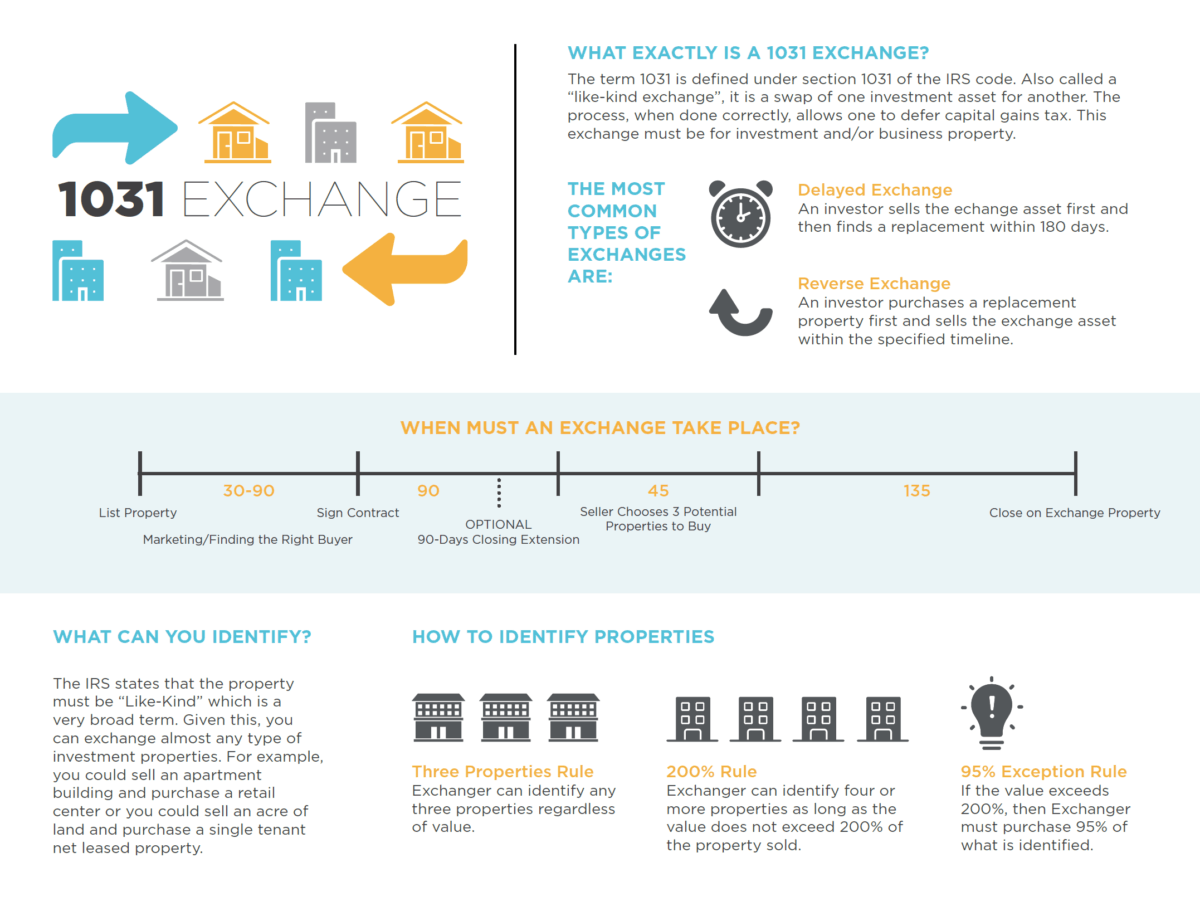

A 1031 exchange is similar to a traditional IRA or 401k retirement plan. Its use permits a taxpayer to relinquish certain investment property and replace it with other like-kind. What does tax deferred exchange mean.

Also known as Like-Kind. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free. Under the Internal Revenue Code Section 1031.

What exactly does that mean. Learn More About Like-Kind Property Exchanges At Equity Advantage. Attend A Free Webinar.

The exchange can include like-kind. The Tax Deferred Exchange. 1031 Tax-Deferred Exchange Definition.

As part of a qualifying like-kind exchange. Ad Maintain The Value Of Your Investment Property. Ad Understand the benefits of the 1031 exchange program to defer 100ks in capital gains.

A 1031 Tax Deferred Exchange is one of the few tax shelters remaining. You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same. A legal definition of a 1031 exchange is a real estate transaction to sell properties for investments or to acquire replacements.

It is not a tax-free event. 1031X is the preferred 1031 exchange company for thousands of investors. The state law of the jurisdiction in which the property is held decides the definition of the interest in real estates like mineral interests or water rights.

Ad Exclusive off-market Delaware Statutory Trust offerings w6 - 8 starting cash flow. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while.

Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Those taxes could run as high.

Ad Invest in Silicon Valley Real Estate. 1031 tax deferred exchanges allow. Learn what it takes to qualify from the Equity Advantage experts - exchange facilitators since 1991.

1031 Exchange Financing Bridge Loans Wilshire Quinn Capital

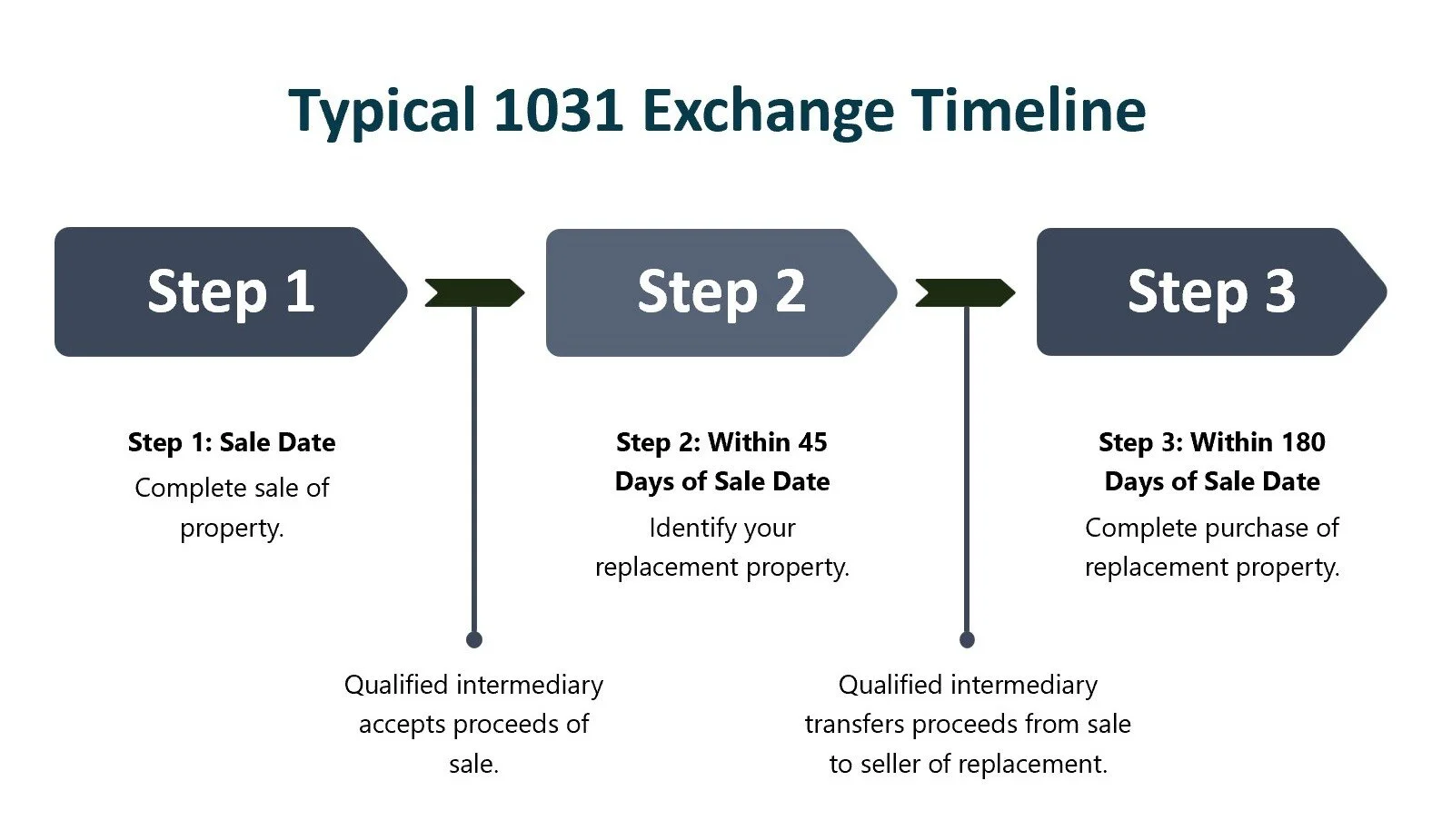

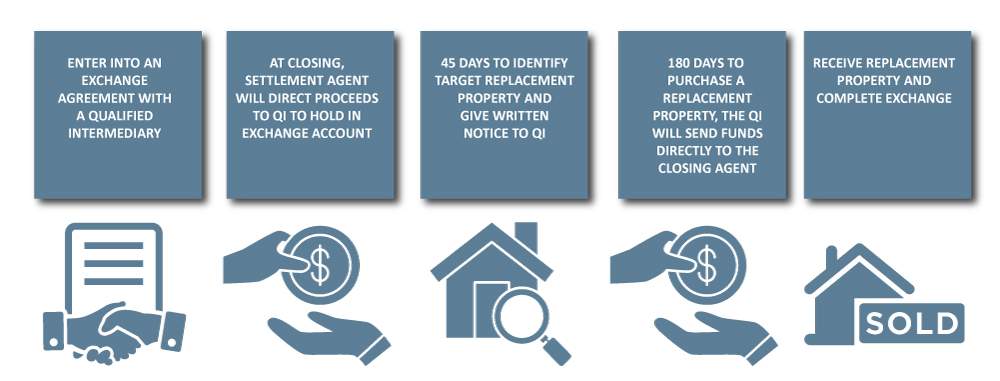

How To Do A 1031 Exchange In Nyc Hauseit New York City

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

Are You Eligible For A 1031 Exchange

How To Do A 1031 Exchange In Nyc Hauseit New York City

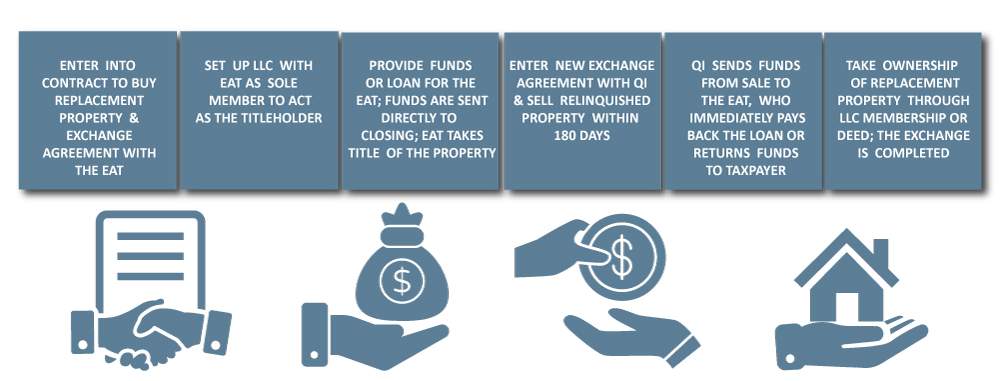

10 Steps Of A Reverse Exchange Accruit Llc

1031 Tax Deferred Exchange Summit Consulting Group Top Real Estate Private Equity Consultant Analyst Investment Broker

What Is A 1031 Exchange Asset Preservation Inc

1031 Exchange Faqs 1031 Exchange Questions Answered

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

1031 Exchange What Is It And How Does It Work Plum Lending

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

1031 Exchange Explained What Is A 1031 Exchange

Irc 1031 Exchange 2021 Https Www Serightesc Com

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Mark D Mchale Associates

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home